Germany: Tax-optimized overtime accounting

The Tax-optimized accounting of overtime is a decisive factor for companies in Germany when it comes to both complying with legal requirements and maximizing employees' net wages. Through a precise Time tracking software overtime worked can be clearly documented and specifically remunerated in such a way that tax-free or tax-privileged bonuses - for example for night, Sunday or public holiday work - are optimally utilized. Those who use modern Time tracking software can not only meet the requirements of the Working Hours Act efficiently, but also sustainably increase motivation and satisfaction in the team through transparent and tax-optimized processes.

Why time recording and tax-free overtime accounting are crucial in 2025

In Germany, overtime has long been an issue not only of workload, but also of tax planning. Since the landmark ruling by the Federal Labor Court (BAG) on the mandatory Time tracking software All companies must monitor the working hours of their provides documenting everything seamlessly. If you implement this consistently, you also lay the foundation for a correct and tax-optimized Overtime accounting.

With clear recording and correct tax valuation, companies can not only minimize legal risks, but also provide employees with tangible net benefits.

Legal obligation to record time in Germany

The Working Hours Act (ArbZG) in conjunction with the BAG ruling obliges companies to systematically record every hour worked. This applies to all working models - from the traditional office to field service to working from home.

It is important that employers not only precisely document the start and end times, but also breaks and overtime. This obligation creates the basis for legally compliant overtime accounting and the targeted use of tax benefits.

Working Hours Act and tax relevance of overtime

The ArbZG not only regulates maximum working hours and breaks, but also influences how overtime is classified for tax purposes.

The distinction between:

- Basic remuneration for overtime (always subject to tax and social security contributions)

- Surchargeswhich are tax-free under certain conditions

You can pay tax-free bonuses for night work, Sunday and public holiday work, for example, as long as the statutory limits are observed. Through an exact Time tracking software can be used to prove exactly when these tax-privileged periods occurred.

Digital time recording as the key to tax optimization

If you want to treat overtime correctly for tax purposes, you not only have to record the working hours, but also to the minute document.

Modernity Time tracking software offers decisive advantages:

- Automatic recognition of work at night, on Sundays and public holidays

- Direct calculation of tax-free allowances

- Interfaces to payroll accounting systems

- Secure cloud storage to fulfill verification obligations

This turns a legal obligation into a tool for tax optimization.

Recording overtime and classifying it for tax purposes - the process

To ensure that overtime is treated optimally for tax purposes, you should implement the following steps consistently:

- Clear approval processes in order to avoid uncontrolled overtime.

- Document promptlywhen and for how long the overtime was worked.

- Type of overtime (e.g. night work, work on public holidays).

- Differentiate billingso that tax-free and taxable portions are clearly separated.

Example:

If a person works 4 hours between 10:00 and 14:00 on October 3 (German Unity Day), these hours can be remunerated with a tax-free public holiday supplement of up to 125 % - in addition to the basic wage.

Tax-optimized payment of overtime - the basics

In principle, the following applies:

- The Basic remuneration for overtime is taxable.

- Surcharges can be tax-free if they are paid in addition to the basic salary and do not exceed the statutory maximum limits.

You are allowed to pay these tax-free supplements in Germany:

- Night work (20:00-6:00): up to 25 % surcharge tax-free

- Sunday work: up to 50 % surcharge tax-free

- Work on public holidays: up to 125 % surcharge tax-free

If you work at night on a public holiday, these supplements can even be combined.

Tax-free vs. taxable overtime pay

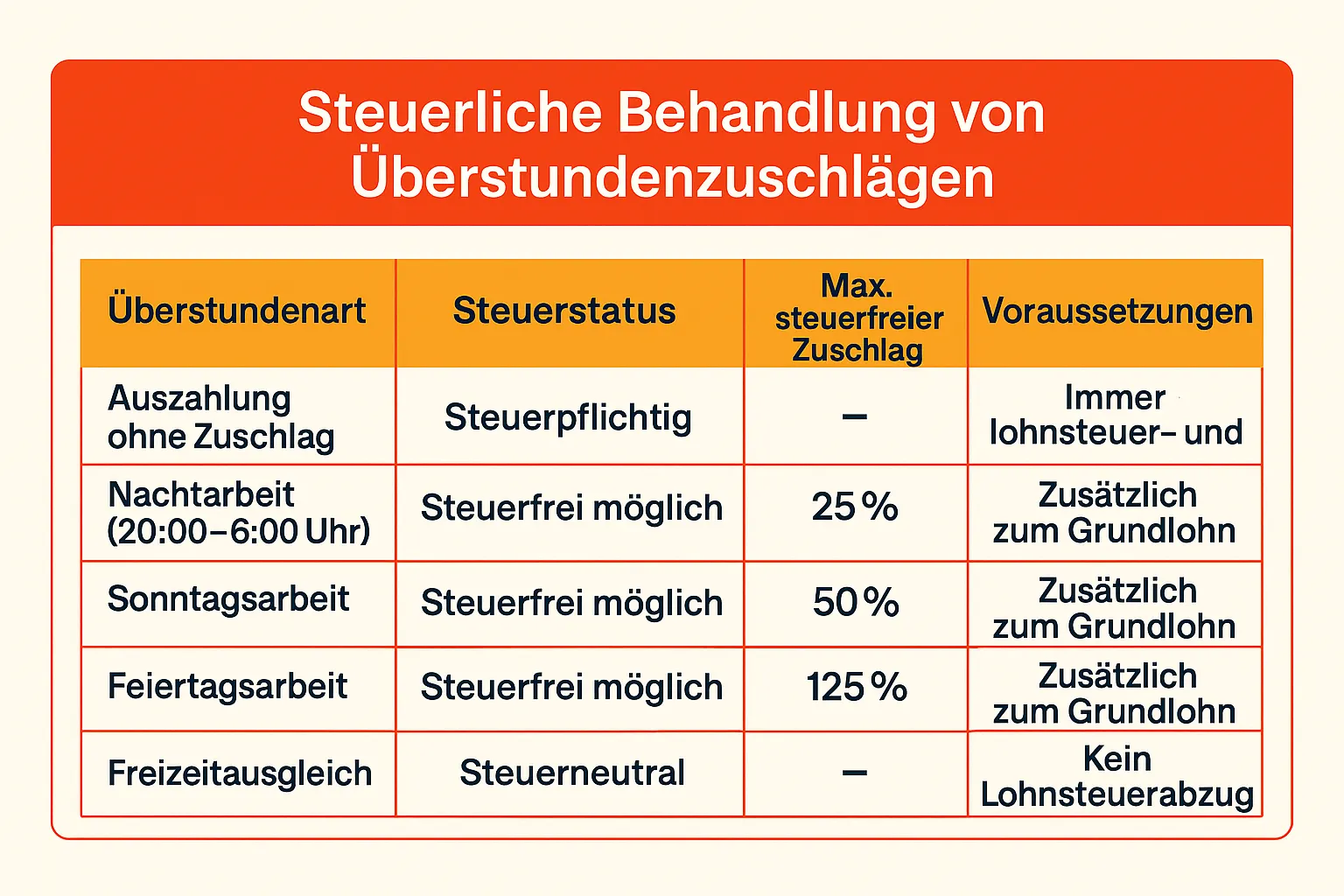

| Overtime type | Tax status | Max. tax-free surcharge | Prerequisites |

|---|---|---|---|

| Payout without surcharge | Taxable | - | Always subject to income tax and social security contributions |

| Night work (20:00-6:00) | Tax-free possible | 25 % | In addition to the basic salary |

| Sunday work | Tax-free possible | 50 % | In addition to the basic salary |

| Public holiday work | Tax-free possible | 125 % | In addition to the basic salary |

| Time off in lieu | Tax neutral | - | No income tax deduction |

Special features and pitfalls in tax valuation

For supplements to remain tax-free, you must strict pay attention to the legal requirements. Common mistakes are

- Payment as a lump sum instead of per hour actually worked

- Supplements "included" in the basic wage

- Missing or unclear documentation of working hours

As a result, the tax office classifies the payments as taxable and demands additional income tax. A precise Digital time tracking prevents these risks.

Time recording in the home office and for flexible working hours

The obligation to record working hours also applies when working from home - including overtime. Here in particular, it often happens that overtime is not formally reported.

With a mobile time recording app you can document working hours on the move or from home and immediately assess them for tax purposes. The software can automatically recognize whether it is tax-free night work and calculate the corresponding surcharge.

Mobile and cloud-based solutions for companies

One Cloud-based time management application offers several advantages for companies:

- Employees can record their times via smartphone, tablet or PC

- Real-time data enables immediate control of overtime development

- Automatic calculation of tax-free bonuses saves time in payroll accounting

- Legal obligations to provide evidence are fulfilled without additional administrative effort

Using tax opportunities instead of just fulfilling obligations

Who in Germany Overtime properly documented and correctly valued for tax purposes can generate considerable benefits - both for the company and its employees. The combination of modern Time tracking software and sound tax knowledge ensures that overtime is not only recorded, but also paid out in a tax-optimized manner.

FAQ - Time recording & tax-free overtime in Germany

Do I have to record my employees' working hours?

Yes, since the BAG ruling, there has been an obligation to Working time recording in Germany. You document the start, end, duration and breaks - ideally with a Time tracking software or one Time recording app.

Which overtime bonuses are tax-free in Germany?

You can apply surcharges additional tax-free on top of your basic salary if you comply with the limits: Night work up to 25 %, Sunday to 50 %, Public holidays up to 125 %. With Public holiday + night work combinations are possible (e.g. up to 150 %).

Is overtime paid out without a supplement tax-free?

No. The pure payment of overtime remuneration remains subject to tax and social security contributions. Tax-free are only the Surchargesif you meet the requirements.

How do I record overtime correctly so that the tax exemption applies?

You record every hour prompt, accurate to the minute and differentiated (normal, night, Sunday, public holiday). One digital time recording Germany with a set of rules automatically recognizes times and assigns the Overtime to the correct surcharge types.

Does working from home count differently?

No. Even when working from home, you document working hours and Overtime complete. A mobile time recording Germany resp. electronic time recording Germany facilitates recording including breaks and overtime.

Is compensatory time off more favorable for tax purposes than payment?

Yes. Time off in lieu remains tax neutral. However, if you pay out, you pay tax on the Basic remunerationwhile Surcharges (if the limits are observed) remain tax-free.

Which tools support tax-optimized overtime accounting?

Rely on time recording software with automatic overhead logic, audit-proof history, export for payroll accounting and mobile app. This is how you fulfill the time recording law Germany and at the same time optimize net wages at Overtime Germany.