Reisekostenabrechnung Deutschland 2026

Following the pandemic-related restrictions, travel activity and thus travel expense reports in Germany will increase significantly again in 2025. While many companies have now established hybrid working models, professional travel for customer visits, project coordination and further training is once again gaining in importance. As a result, the Travel expense management The focus is shifting back to business trips - both from an administrative and a tax perspective. After all, every business trip incurs expenses that need to be properly documented, checked and accounted for.

This article will therefore provide you with a sound overview of the most important aspects of travel expense accounting in Germany. You will also learn how to digital travel expense solutions, mobile applications and Cloud-based tools not only make your processes legally compliant, but also efficient and employee-friendly.

What is a travel expense report - definition and meaning

The Travel expense management is a central component of modern business processes. It documents and reimburses expenses incurred on business trips. This includes in particular Travel costs, Meal allowances, Accommodation packages and various Incidental costs.

The legal basis in Germany is in particular the Income Tax Act (EStG), more accurate § Section 9 (1) sentence 3 no. 4 EStG. It regulates which work-related expenses for meals, accommodation and travel are considered income-related expenses and in what form they can be recognized for tax purposes.

In addition, the Federal Ministry of Finance (BMF) regularly so-called BMF letterwhich specify the application of tax lump sums, reduction rules and special features for trips abroad. Public employees are also subject to specific regulations in the Federal Travel Expenses Act (BRKG) as well as the corresponding state travel expense laws (e.g. LRKG NRW).

Correct accounting is not only relevant for tax purposes, but also important for internal transparency, accounting and verifiability by the tax office.

What costs can be reimbursed?

According to German travel expense law, the following are generally eligible for reimbursement:

- Travel costs (e.g. train, flight, mileage allowance)

- Additional expenses for meals (flat rate depending on duration of absence)

- Accommodation costs (against proof or as a lump sum)

- Incidental travel expenses (e.g. parking fees, tolls, luggage storage)

The current Travel expense guidelines Germany. The reimbursement may vary depending on the company - but the tax deductibility is always based on the legal requirements.

Verpflegungspauschalen 2026 im Überblick

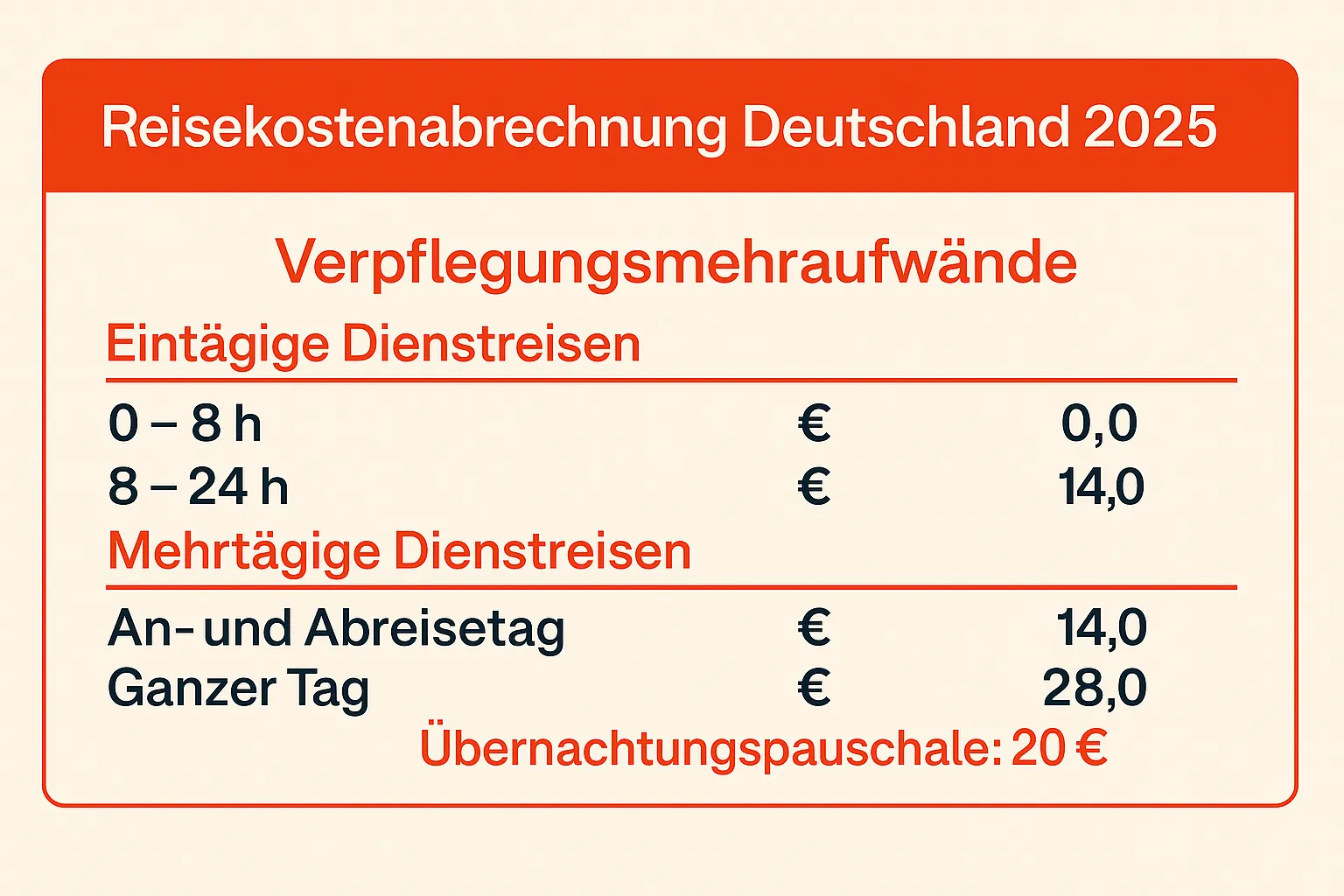

The flat rates for additional meal expenses in Germany will remain unchanged in 2025 unchanged. The following tax-recognized amounts continue to apply:

| Duration of absence | Meal allowance 2025 |

| 8 to less than 24 hours | 14 EUR |

| Multi-day trip - arrival or departure day | 14 EUR |

| Full 24-hour absence | 28 EUR |

These values apply nationwide and are reimbursed tax-free if the requirements are met. Adjustments have only been made to certain foreign flat rates, but not in Germany.

Special features of additional expenses for meals and overnight stays

Additional expenses for meals do not apply if meals are provided. In this case, reductions must be made:

- Breakfast: Deduction 20 % the daily flat rate

- Lunch/dinner: Deduction 40 each %

Accommodation packages for domestic trips are all-inclusive 20 EURif no hotel bill is presented. Different flat rates apply abroad, depending on the country.

Lump sums for business trips abroad

With Business trips abroad country-specific flat rates apply, which are published annually by the Federal Ministry of Finance (BMF). They are based on the average cost of living in the respective country and apply to both Additional meal expenses as well as for Accommodation costs.

Beispielhafte Auslandspauschalen 2026:

| Destination country | Catering (24 h) | >8 hours | Overnight stay flat rate |

| Austria | 50 EUR | 33 EUR | 117 EUR |

| Switzerland | 64 EUR | 43 EUR | 180 EUR |

| France | 53 EUR | 36 EUR | 105 EUR |

The exact height depends on the Country of residence and duration of absence from. Special rules apply for arrival and departure days and intermediate days:

- Arrival and departure day: The flat rate of the country in which the overnight stay takes place counts. For the return journey to Germany, the last foreign country counts.

- Intermediate days: The decisive factor is the place where the person traveling is located. 24:00 local time stays.

Important: If meals are provided, deductions must be made as in Germany (20 % for breakfast, 40 % each for lunch and dinner). The foreign flat rates apply exclusively to business trips and may not be applied as a lump sum for private stays abroad.

How does a digital travel expense report work?

The Digital travel expense report replaces paper-based processes with automated workflows and ensures greater efficiency in the company. With modern Business trip software or a Travel expenses program employees can enter their receipts directly, categorize them and process them according to the valid Travel expense guidelines Germany account.

Typical functions of a professional tool for Digital travel expense report are:

- Automated calculation of Meal allowances 2025 by duration of absence

- Integration of Accommodation packages and incidental travel expenses

- Approval workflows for supervisors and accounting

- Mobile access via a App for travel expense reports

- Connection to financial accounting or tax office via interfaces

Such solutions are particularly suitable for companies with a large number of field trips or complex Travel expense management.

Advantages of modern business travel software

The use of specialized Business trip software offers numerous advantages for companies and organizations that regularly work with Travel expense reports have to do. Modern tools ensure:

- Transparency through centralized data management

- Time saving through automated Travel expense report tools

- Error avoidance through clear input structures and intelligent plausibility checks

- Fast processing through mobile recording via Travel expense report app

- Cloud-based travel expense managementwhich enables location-independent working

For larger companies in particular, the use of such software offers the opportunity to Efficient, legally compliant and audit-proof billing system. Integration into existing ERP or HR systems creates additional synergies.

Relevant deadlines, obligations to provide evidence and storage

Certain rules apply to the travel expense report Deadlines and obligations to provide evidence:

- As a rule, travel expenses must be paid within 6 months after the end of the trip (shorter if necessary within the company).

- For the tax deduction The following applies: Expenses must be substantiated by receipts or lump sums.

- The retention period for billing-related documents is 10 years.

Tip: Companies should define clear guidelines on deadlines, documentation requirements and responsibilities in order to create legal certainty.

Dealing with mixed travel (private and business)

Become Business trips with private stays combined, applies:

- Only the portion attributable to work of the costs is refundable and tax-deductible.

- Hotel costs and travel expenses must be divided proportionately if they are used for mixed purposes.

- Meal allowances apply only for business travel days - the vacation day in between does not count.

For mixed trips, we recommend a clean separation in planning and billing. Some software solutions offer specific fields or notes on separation for this purpose.

Automated travel expense accounting saves time and money

The correct Travel expense management under German law is characterized by many details. Digital solutionsin particular Cloud-based business travel softwareoffer considerable advantages.

With the right App for travel expense reports and automated processes, time, costs and errors can be minimized - and at the same time the Employee satisfaction increase.

Frequent Ask Questions - FAQs

What are additional meal expenses and how are they calculated?

Additional subsistence expenses are flat-rate reimbursements for meals during business trips. They are based on the duration of the absence and amount to EUR 14 (>8h) or EUR 28 (24h) in Germany. Country-specific flat rates apply abroad.

What flat rates will apply in Germany in 2025?

The domestic flat rates will remain unchanged in 2025: EUR 14 for more than 8 hours and EUR 28 for 24 hours of absence. A flat rate of EUR 20 applies for overnight stays if no invoice is available.

How is the reduction made for provided meals?

If breakfast is provided, 20 % of the daily flat rate must be deducted, and 40 % each for lunch or dinner. This reduction applies both at home and abroad.

What applies to trips with a private component?

Only the work-related part of the trip is reimbursable. Costs must be split proportionately if professional and private purposes are combined.

How long do travel expense receipts have to be kept?

The legal retention period is 10 years. Companies should use audit-proof archiving systems.

Book your non-binding introductory appointment

Simply arrange a short, no-obligation appointment with us. In just a few minutes, we will show you the advantages of the Personalwolke travel expense accounting software and app - and how your company can benefit from a modern, digital solution. Select a suitable time below.