How are travel expenses and mileage allowances correctly accounted for in Austria in 2025?

Correct billing of the Travel costs is one of the central elements of the Travel expense report in Austria. It is not only a matter of recording expenses and kilometers, but also of observing tax regulations, legal framework conditions and operational processes. Particularly due to the increasing use of digital expense reports, Business trip software and mobile travel accounting solutions the demand for accuracy and automation increases. In this article, we will show you in a well-founded and practical way how to bill travel expenses efficiently and in compliance with the law.

Why correct travel expense accounting is so important

Travel costs are a frequent and relevant form of expenditure for companies - whether for field service, customer visits or project trips. At the same time, they are relevant for tax purposes and must be documented in a comprehensible manner for the tax office. For employees, transparent, automated accounting means less effort and more predictability. In turn, companies benefit from clear processes and less susceptibility to errors.

What counts as travel expenses for the purposes of travel expense accounting?

As part of the Travel expense report Travel costs are deemed to be those expenses incurred when a journey for business purposes is made by means of transportation. These include

- Travel by private car (mileage allowance)

- Travel by public transportation (train, bus, flight, cab)

- Trips with the company car (often via fuel card or internal tool)

It is important to note that journeys between home and your first place of work are not considered travel expenses, but rather distances - they are regulated differently for tax purposes.

Mileage allowance and official rates in Austria

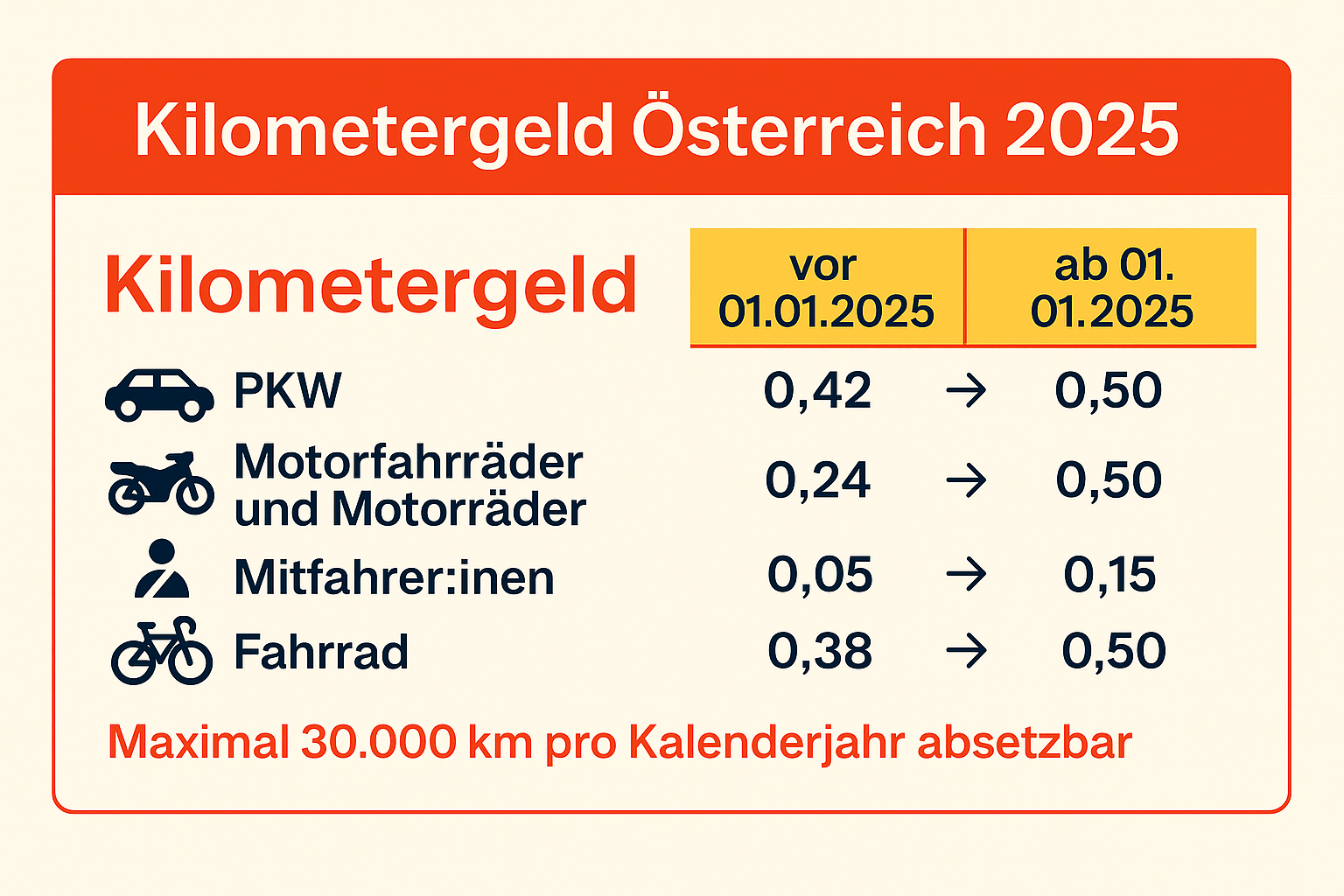

Anyone traveling by private car on business in Austria can Mileage allowance in the amount published by the BMF. The values differ depending on the accounting period. The following table shows a direct comparison of the rates valid until the end of 2024 and the rates valid from January 1, 2025:

| Vehicle type | until 12/31/2024 (EUR) | as of 01.01.2025 (EUR) |

| PASSENGER CAR | 0,42 | 0,50 |

| Motorcycles and motorcycles | 0,24 | 0,50 |

| Passengers | 0,05 | 0,15 |

| Bicycle | 0,38 | 0,50 |

In addition, a maximum of 30,000 km per calendar year per employee are deductible. The amounts are tax-freeprovided that the requirements of the income tax guidelines are met.

Requirements for tax-free travel expense reimbursement

So that the Settle mileage allowance tax-free, the following conditions must be met:

- The trip is business-related

- This is not a regular journey to the place of work

- The route actually traveled is documented

- The vehicle is the property of the person traveling

- Settlement takes place within the framework of the official mileage allowance

Difference between one-way and return journey

A common mistake is that only the one-way distance is stated. For full reimbursement of travel expenses, you must clearly document whether it is:

- a one-way trip (e.g. for air travel or business trips with a return flight)

- a return journey (e.g. customer visit by car on the same day).

The exact specification is not only important for the Review of travel expense reportsbut also essential for subsequent tax assertion.

Which journeys are deductible?

The following are generally deductible:

- Trips to customers or business partners

- Project-related travel outside the usual place of work

- Routes to seminars, training courses or trade fairs

- Business trips outside the business premises during working hours

However, the following are not deductible:

- Travel between home and work (see commuter allowance)

- Private trips (even if they take place during a business trip)

Reimbursement of travel expenses with own car vs. company car

When employees use their own car the reimbursement is made via the Mileage allowance. If a Company car the mileage allowance does not apply - different rules apply here:

- Travel costs are borne by the company (e.g. via fuel card)

- Private use can be recognized as a benefit in kind for income tax purposes

- A separation of business and private must be ensured for accounting purposes

Special features for car pools and business trips with several people

If a vehicle is shared, the person driving the vehicle may use the Mileage allowance plus carpooling allowance settle. The following applies:

- EUR 0.50 basic amount per km (car)

- plus EUR 0.15 for each passenger (max. 4 persons)

Important: The names of the passengers and the reason for the trip must be documented. This will help you avoid tax-related queries and ensure traceability.

Digital solutions for mobile travel expense accounting

With a App for travel expense reports or a browser-based tool, travel expenses can now be recorded easily and regardless of location. Advantages:

- Automated mileage calculation via Google Maps integration

- Photograph receipts and assign them directly

- Integration into HR and ERP systems possible

Non-cash benefits and company car

If employees are given a Company car The tax consequences of this are as follows. The so-called Benefit in kind describes the benefit of private use of a company vehicle and is recorded for income tax purposes. The following regulations must be observed:

- Obligation to receive benefits in kindIf a company car may also be used privately, a flat-rate benefit in kind must be added to the salary each month.

- Calculation basisThe non-cash benefit value is generally 2 % of the gross list price, up to a maximum of EUR 960 per month. Reduced values apply for low-emission vehicles.

- Separation private / businessIf it can be proven that the vehicle is used exclusively for business purposes (e.g. by means of a logbook), the benefit in kind does not apply.

- Reimbursement of travel expenses: No mileage allowances are payable for business trips with the company car, as the costs are borne by the company.

In practice, the use of an electronic logbook is recommended for company vehicles in order to properly document private and business use and secure tax benefits.

How to make travel expense accounting work in practice

Who Travel costs in Austria correctly and digitally, saves time, reduces sources of error and meets all tax requirements. Whether Mileage allowance, Additional expenses for meals or other components - modern tools enable transparent, compliant and efficient implementation.

FAQ - Travel expense accounting in Austria

How much mileage allowance can I claim in Austria from 2025?

From January 1, 2025, you may claim EUR 0.50 per kilometer for business trips by car, motorcycle or bicycle. In addition, you can claim a further EUR 0.15 per kilometer for each person traveling with you, provided the names are documented.

How many kilometers can I claim tax-free per year?

You can claim up to 30,000 kilometers per calendar year with the official mileage allowance - provided that the journeys are all for business purposes.

How does billing for carpooling work in practice?

If you take other colleagues with you, you may charge an additional EUR 0.15 per kilometer for each person. However, make sure you enter the name and purpose of the journey for all passengers.

Under what conditions is mileage allowance tax-free?

In order for the mileage allowance to remain tax-free, the journey must be necessary for work, the route must be correctly documented and the vehicle must be owned by the person making the journey. In addition, the officially specified mileage allowance must be used.

Which software helps with billing?

Digital tools such as a Personalwolke travel expense report app or a Travel expense software with Google Maps integration, document entry and cloud function make the process much easier.

Book your non-binding introductory appointment

Simply arrange a short, no-obligation appointment with us. In just a few minutes, we will show you the advantages of the Personalwolke travel expense accounting software and app - and how your company can benefit from a modern, digital solution. Select a suitable time below.