Travel expenses Austria 2024

Travel expenses for business trips in Austria - settlement of overnight and daily allowances

Travel expense accounting in Austria often leaves heads spinning, so we would like to refresh your knowledge of accounting for overnight and daily allowances.

In Austria, travelers are only reimbursed for travel expenses incurred if it is a Business-related travel is involved. This is the case if:

- employees travel more than 25 kilometers from the place of work (also the center of activity) for operational reasons and

- the journey lasts at least three hours and

- no other activity is the focus of the trip.

The travel diets in Austria are made up of the following components:

Daily allowance

As already mentioned above, the entitlement to a daily allowance only arises from the 26th kilometer of a journey.

- The daily allowance is € 2.20 per hour started.

- It can Paid for a maximum of 12 hours per day This results in a daily maximum of € 26.40 (tax-free).

- If the employer provides a meal, i.e. dinner or lunch, the daily allowance is reduced by € 13.20 for each meal.

For business trips abroad, instead of the standardized daily allowance rate of € 26.40, a daily rate for the respective country is used as the basis for calculation.

All foreign maximum rates can be HERE can be viewed.

Overnight allowance

For business trips within Germany, € 15.00 per overnight stay must be reimbursed without proof of actual costs.

If the costs of the overnight stay (including breakfast) are proven by submission of a receipt, the actual costs incurred can be reimbursed.

Travel costs

Travel expenses include all expenses incurred for means of transportation such as bus, train, cab or plane. As well as other expenses for motor vehicles in connection with business activities.

Mileage allowances may only be paid for vehicles that are part of the employee's private assets and therefore not part of the company's assets.

- Currently the Kilometer allowance € 0,42 per kilometer driven

- for the A surcharge of € 0.05 is levied for the transportation of persons required for operational purposes. calculated per person

Note: From a tax perspective, the mileage allowance covers all costs incurred by the employee in connection with the vehicle. If the employer nevertheless reimburses the employee for a parking ticket, for example, this must be paid out subject to tax.

Note:

It should be noted that the individual settlement rates and settlement modalities may vary depending on the applicable collective agreement. In addition, a distinction must be made between tax-free daily allowance and the actual income paid out in accordance with the collective agreement or company regulations.

Our tip for HR experts

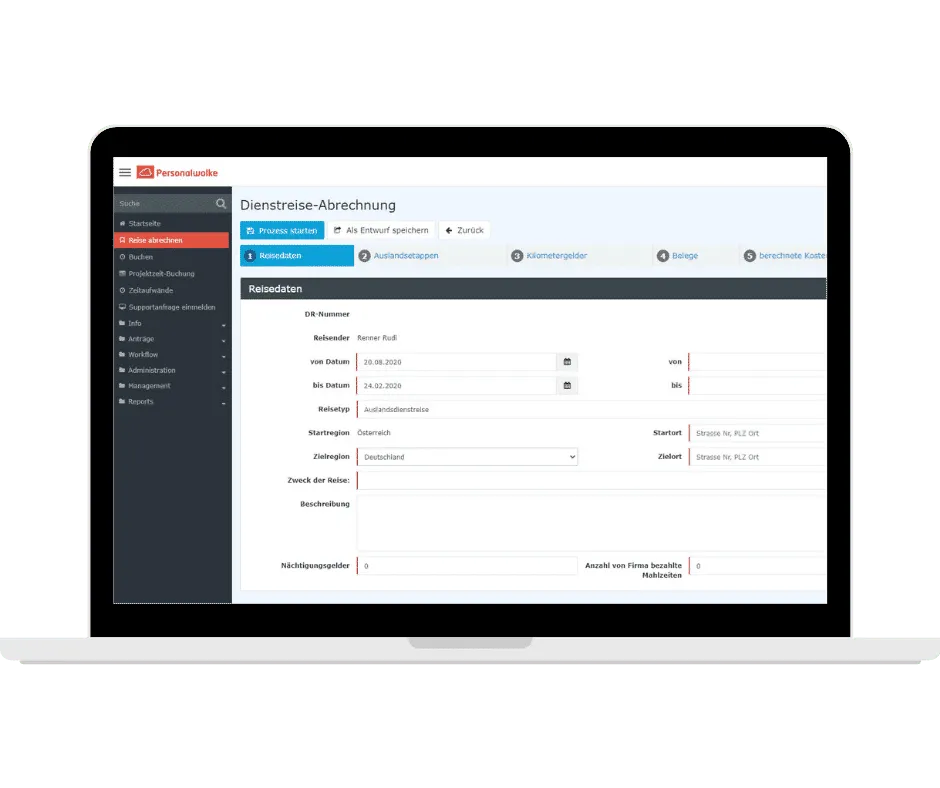

With the Personnel Cloud Travel module take your travel expense accounting to the next level.

- Overnight and daily allowances are automatically calculated according to your CT, even the mileage allowance can be shown in seconds thanks to Google Maps integration.

- By simply entering foreign stages, even foreign business trips become child's play.

- The travel receipts of your travelers can be uploaded directly so that you have all the data collected digitally in the travel folder.

- Invoiced business trips can be automatically transferred to the payroll or accounting program.

News on travel expense accounting 2024 in Austria

- No fundamental changes have been made by the legislator with regard to the tax-free settlement of business trips.

- but Attention Depending on the collective agreement, the amounts paid out may have increased.

For example, the collective agreement for metalworkers includes higher daily allowances than the EUR 26.40 per day stipulated by law. An adjustment must therefore be made here. Personalwolke customers benefit from an automatic adjustment!