Travel smart, bill in compliance with the law

Travel expense accounting for companies in Austria

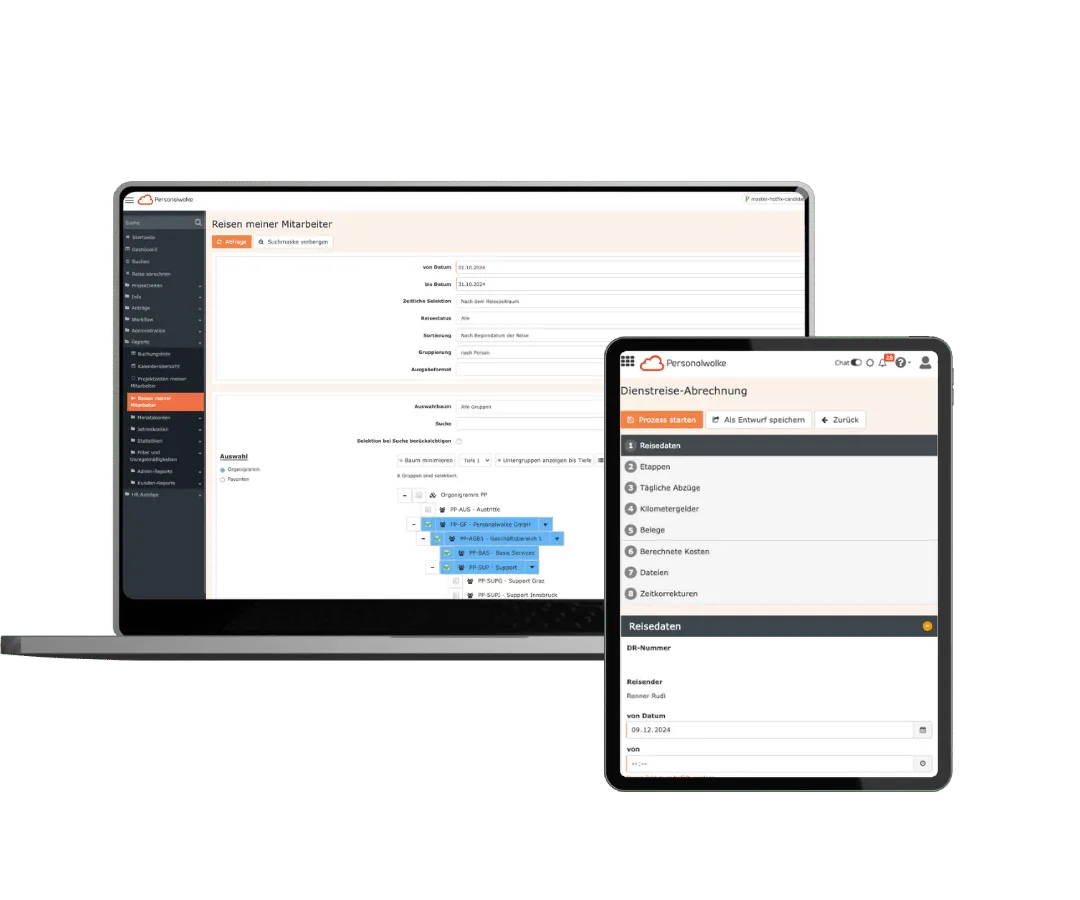

Personalwolke Travel is one of the leading modular travel management software solutions for modern, digital and legally compliant Travel expense accounting in Austria. With travel and expense management system fulfills all legal requirements, supports you in the efficient billing of business travel expenses, daily allowances, and travel costs. With integrated expense management software, you can automate workflows, ensure compliance, and simplify reimbursement for mileage and travel expenses. Thanks to cloud technology, our corporate travel management tool can be used worldwide. Put an end to paperwork and rely on a Professional, automated travel expense reporting software that makes travel and billing in Austria easy, transparent, and compliant.

Personalwolke Travel is one of the leading modular travel management software solutions for modern, digital and legally compliant Travel expense accounting in Austria. Put an end to paperwork and put your trust in a Professional, automated travel expense reporting software that makes travel and billing in for your company.

50,000+ end users ⭐️⭐️⭐️⭐️⭐️

trust in the Personalwolke

Modern, automated travel expense management - especially for Austria

With Personalwolke Travel rely on a cloud based travel expense management software designed for the Legally compliant application, recording and accounting of travel expenses. The tool automatically calculates daily allowances, accommodation costs, per diems, and mileage allowances in accordance with Austrian law. Manual checks and complex calculations are no longer necessary - instead, you benefit from a secure, digital and seamlessly integrated travel and expense management system. Our corporate travel management software ensures transparency, compliance, and efficiency in every step of your business travel reimbursement process.

- Travel expense management quick and easy recording - at home and abroad

- 100% GDPR-compliant and confidential expense management tool

- Digital receipts immediately integrate, manage and Automated settle

- Outlook calendar synchronization for even more efficiency

- Travel guidelines and Approval processes Integrate individually

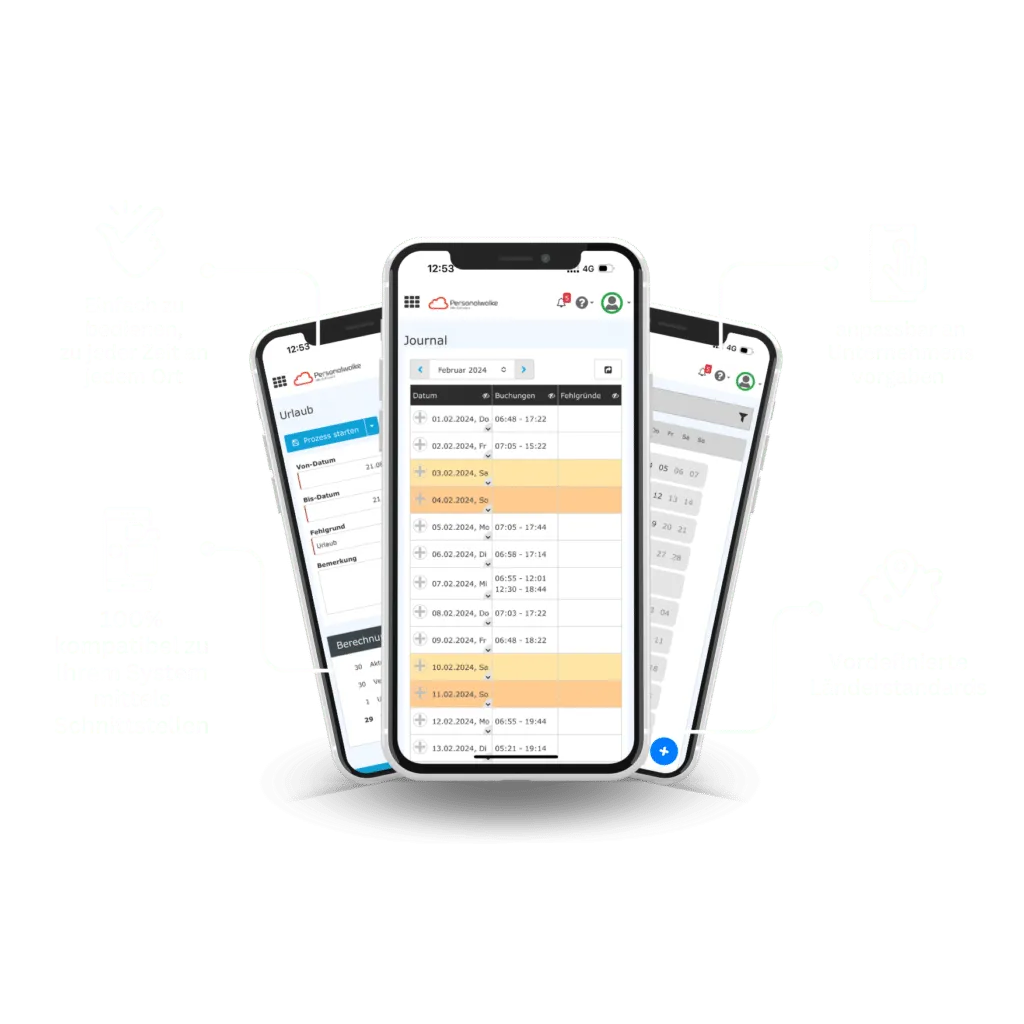

- Mobile app available for on the go travel reimbursement and submission

Digitizing the processes

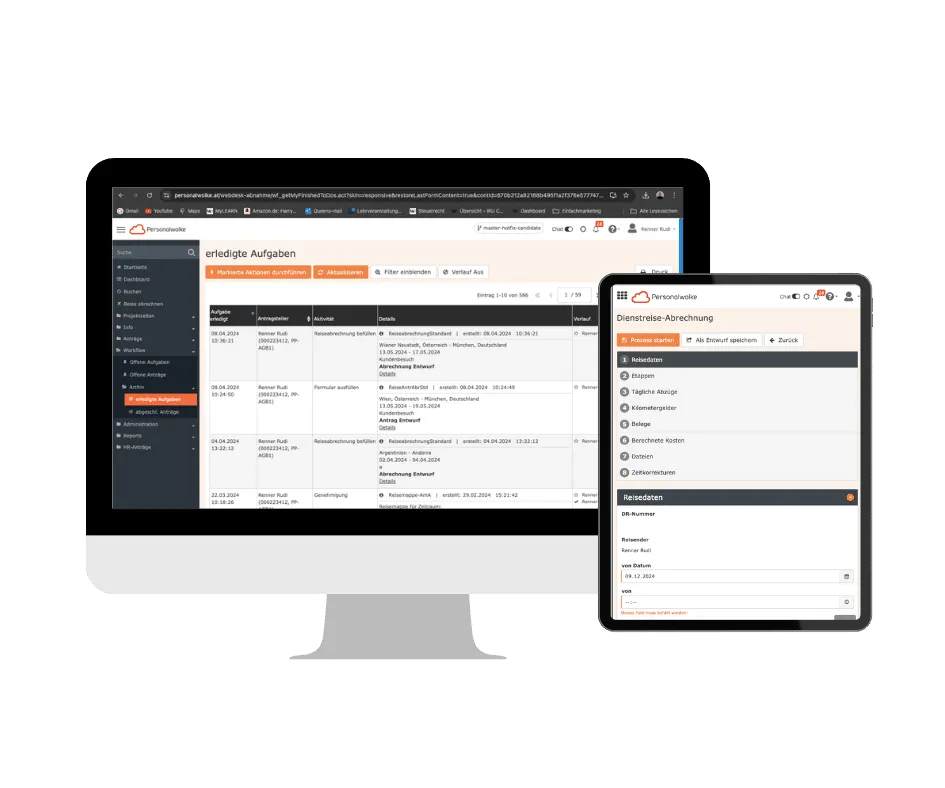

Personalwolke offers you sensibly predefined standard processes for your travel and expense management software. On request, these can be precisely adapted to your company’s travel guidelines or specific approval workflows. Our corporate travel management system is 100% compatible with your existing infrastructure thanks to customizable interfaces, ensuring seamless data exchange between HR, payroll, and accounting.

AT and International

Personalwolke also supports international corporate structures with predefined country standards. Legal requirements are mapped simply and clearly — ideal for organizations managing business travel reimbursement across borders. Our cloud-based solution connects teams and transports information to the right place.

All-In-One employee portal

The Personalwolke portal provides an integrated platform for all employees — with full visibility of current and planned absences, business trips, and travel requests. Save valuable time with an intuitive online travel expense management tool that lets you focus on strategic decisions instead of administrative tasks.

Highest safety standards

Security is our top priority. Our travel and expense software meets the highest data protection requirements and is fully GDPR-compliant. Many security features ensure that your data remains secure.

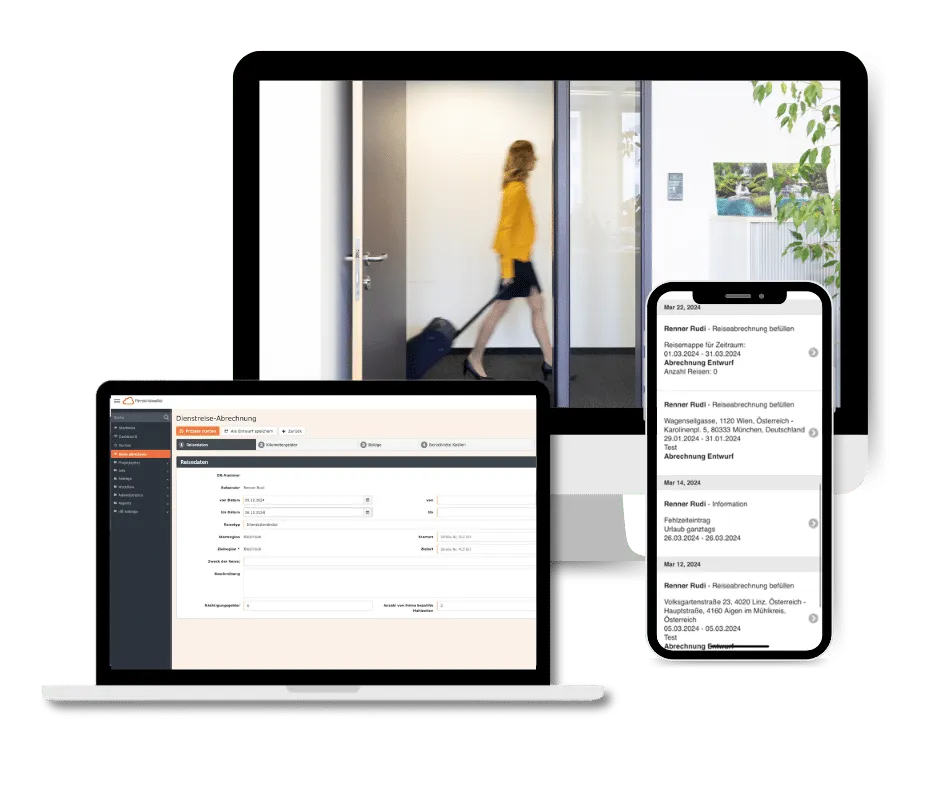

Mobile travel expense recording and accounting - anytime, anywhere

With Personalwolke you can easily apply for, track, and bill business trips directly from your smartphone. The mobile travel expenses app enables a fast and flexible workflow - whether in the office or on the go. All Travel expense receipts are recorded digitally and Modern interfaces synchronized with your system. Additional Approval processes and tests can be conveniently set up. Our mobile travel management software gives you complete control over travel reimbursement and reporting, no matter where your employees are.

- Mobile access and paperless processing for all employees

- Digital receipt entry via smartphone or tablet

- Additional modules for individual approval workflows

Customizable travel expense reports and workflows for every business trip

With Personalwolke Travel, you benefit from a fully digital and customizable Travel expense management that guides you through every step of the process — from travel application to billing— regardless of how many destinations or travel days are involved.

The integrated wizard ensures full compliance with your company’s travel policies and automatically detects all expenses, daily allowances, and mileage reimbursements. This intelligent travel expense reporting software saves valuable time, prevents errors, and guarantees complete transparency for every business trip accounting.

The HR software that grows with you.

Personalwolke is a modern, modular, and expandable HR management softwarethat grows with your business. Add new modules at any time to optimize your HR and employee time management processes, automate routine tasks, and adapt the system perfectly to your organization’s needs. We’ll be happy to provide non-binding consultation and help you find the ideal solution for your business..

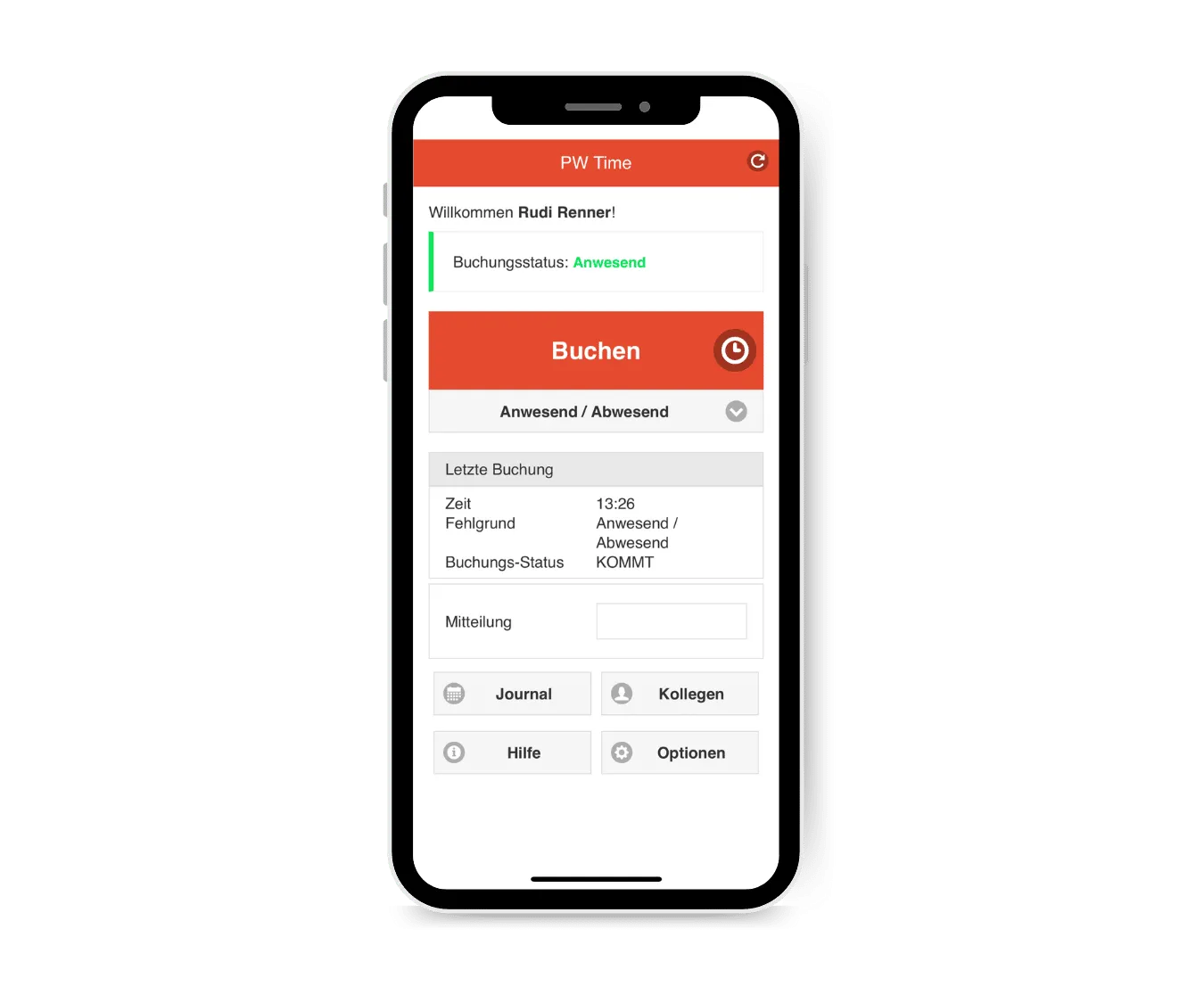

Time Personalwolke

- Location-independent and simple

- Preparatory payroll accounting

- Detailed reports

- Digital approval process

Personalwolke Travel

- Digital travel expense report

- Upload receipts directly

- Automatic expense calculation

- Payroll connection

Project Time Personalwolke

- Live bookings of project times

- Comparison of project & working times

- Billing of billable services

- Comprehensive reports

HR Cloud HR Expert

- Digital personnel file

- Personnel administration

- Dashboard & Reports

- Digital payslip & salary reporting

FAQ's

Do I need IT skills to set up and manage the Personalwolke?

No. Our experienced Experts are available to you both for the Set-up phaseas well as for any questions that may arise.

What do I need to install for Personalwolke?

Nothing. You can use the Modules of the personnel cloud via web with all common browsers (Google Chrome, Firefox, Safari) and need to start the no additional software.

Is it possible to use only the travel expense report module?

Personalwolke has a modular structure. It is possible to choose only the module Travel expense management to use. By Customizable interfaces can use the Personalwolke be connected to your system.

Is the system GDPR compliant?

Personalwolke fulfills all Requirements of the EU General Data Protection Regulation and is data protection compliant in accordance with the EU GDPR.

How many employees is the Personalwolke suitable for?

Personalwolke is for small The company up to large corporations suitable. You determine the Number of employees in the system - and we only calculate the Monthly costs per user from.

Can my data be imported from a third-party system into the Personalwolke?

If the requirement exists, a Automatic data import be realized as long as they are in a electronic form available (e.g. CSV file). This means that Personal master data or Project master data incl. structures can be imported.

Is it possible to record business trips on mobile devices?

Yesthrough our responsive Web app können business trips can be recorded via smartphone. Especially the receipt upload of the Travel expenses through the camera of the cell phone facilitates the process.

Fair prices for companies of all sizes

Travel

from

€ 4,64

per user

/ month

- Adapted to your guidelines

- Modularly expandable at any time

- Attractive discounts when using several modules

- Incl. consulting & implementation by HR experts

- 36 months commitment (flexible on request)

- Price for company size: 76-100

Request price now

Please answer the following questions so that we can prepare a suitable offer for you.

What our customers say:

Josef Steininger

"Simple time tracking using a terminal and cell phone app is ideal, as well as a further step towards paperless/electronic administration and archiving."

Sabine Bergsleitner, BA

"It was important for us to find HR software that is simple and transparent to use, but can still map the complexity of our industry and our company. Thanks to Personalwolke, we were able to significantly reduce our administrative workload and take another important step towards digitalization."

Falkensteiner Michaeler Tourism Group AG

"Personalwolke has simplified our HR processes. The support is extremely competent and fast. We are very happy to have such a reliable time management partner at our side, especially now during the Covid-19 crisis. We can highly recommend Personalwolke in every respect."

Personalwolke Travel Features

Travel

+ Time

+ Project Time

+ HR expert

Employee Self Service:

Travel request

-

-

-

Domestic travel expense report

-

-

-

Travel expenses abroad

-

-

-

Document entry via smartphone

-

-

-

Google Maps integration KM money

-

-

-

Google Maps Integration Start / Destination

-

-

-

Costs / resource-dependent workflows

optional

-

-

-

Distinction between tax-free / taxable

-

-

-

Calculation of allowances according to collective agreement

-

-

-

Calculation of customer-specific flat rates

-

-

-

Advance

-

-

-

Daily allowance deductions Meals

-

-

-

Customized approval workflows

optional

-

-

-

Assignment of trip to cost center & evaluation

-

-

-

Absence for trip request in time recording

-

-

-

Recording travel times

-

-

-

Assignment of project from project time

-

-

optional

-

Workflow for A1 certificate

-

-

-

optional

Manager Self Service:

Evaluation of travel expenses

-

-

-

Approval of travel requests / invoices

-

-

-

Customized reports

optional

-

-

-

Excel reports

-

-

-

PDF export

-

-

-

Automatic report dispatch by e-mail

optional

-

-

-

Admin reports

-

-

-

Administration:

Notification system

-

-

-

Employee master data

-

-

-

Authorization management

-

-

-

Web services(API)

optional

-

-

-

Wage/salary interface

optional

-

-

-

Accounting interface

optional

-

-

-

Automated import of master data

optional

-

-

-

Single Sign On

optional

-

-

-

2 factor authentication (Google Authenticator)

-

-

-

Outlook calendar sync

-

optional

-

-

Activate Out-Of-Office automatically

-

optional

-

-

Data warehouse / reporting module

optional

-

-

-

Support via chat

-

-

-

Support by email / service desk / telephone

-

-

-

Free web seminars for existing customers

-

-

-

Automatic export of receipts to personnel file

-

-

-

optional

Automatic receipt export for external systems

optional

-

-

-

Digital travel expense report in accordance with Austrian law

With Personalwolke you rely on a Digital travel expense reportwhich are specially tailored to the legal requirements in Austria is customized.

Whether Daily allowancesmileage allowance, per diems or expense allowances - all Settlements are carried out fully automatically and in accordance with the applicable regulations. So you benefit from modern, legally compliant and efficient processing of your Business trips and travel expenses.

Automated expense report and daily allowance calculation

Forget error-prone manual calculations: the Automated expense report and daily allowance calculation from Personalwolke takes over all Calculations daily allowances, accommodation costs, per diems, and mileage allowances Austrian tax and labor law for you.

Authorized Expenses, Accommodation costs and Daily allowances are correctly recorded in the system and directly billed digitally - for maximum accuracy and time savings.

Mobile billing of business trips - anytime and anywhere

Whether in the office, in the Home office or on the road: With the mobile travel expense accounting of Personalwolke you and your employees can Business trips, expenses and receipts digitally at any time and from anywhere.

The intuitive app enables paperless workflowsdirect document uploads and Immediate approval processes - flexible and efficient for modern day-to-day business.

Secure and GDPR-compliant management of your travel data

Data protection is a top priority at electronic travel expense report of Personalwolke in first place.

Your Travel expense data are transmitted in encrypted form, stored securely and stored exclusively in certified data centers processed in Austria. This means you fulfill all GDPR requirements and ensure maximum security and confidentiality for all sensitive business travel data.

Seamless integration with your accounting and HR software

Thanks to modern interfaces the personnel cloud can be Travel expense management simply into your existing Accounting and HR software integrate.

All relevant data such as Expenses, daily allowances and travel costs are transmitted automatically and are available for the Payroll accounting, bookkeeping or HR controlling without media discontinuity. This saves you time, avoids Duplicate data entry and ensure an end-to-end digital workflow.

Advantages of paperless travel expense accounting for companies

The Paperless travel expense report with Personalwolke brings companies numerous Advantages: Reduction from Administrative expenses, Lower error rate and faster processing of Travel expense claims.

Digital receipts and automated processes ensure greater efficiency, transparency and Traceability - and help at the same time, Save costs and protect the environment.

Transparent evaluations and real-time reports on travel expenses

With Personalwolke you always have an overview: Comprehensive evaluations and Real-time reports provide you with all the key figures relating to your Travel expenses, Expenses and business trips.

Individually customizable dashboards allow you to Transparent cost control for companies, employees and the accounting department - and thus provide support with Budget planning and controlling.

Test travel expense report software free of charge - 30 days without obligation

Convince yourself of the Advantages of digital travel expense accountingTest Personalwolke 30 days free of charge and without obligation.

Experience how simple, efficient and secure digital administration can be, Recording and billing from Travel expenses can be in your company - and bring your Travel expense management to the next level.

Would you like to find out more about travel expense management with Personalwolke?

Frequently asked questions about travel expense accounting

What is a legally compliant travel expense report in Austria?

One legally compliant Travel expense management in Austria records and documents all business-related expenses, such as Daily allowances, expenses, travel costs and accommodation allowancesin accordance with the current legal regulations and travel guidelines.

How does Personalwolke support digital expense and travel expense accounting?

With Personalwolke you can easily apply for, track, and bill Travel expenses, Expenses and Daily allowances digitally record, manage and automate billing. The software takes into account all Austrian requirements, integrated digital receipts and facilitates the Administration from business trips for employees and companies.

What are the advantages of cloud-based travel expense accounting?

One Cloud-based travel expense accounting enables the location-independent access, automated calculations from Daily allowances and Expenses, digitizes receipts and ensures paperless processes as well as maximum data security and transparency.

Can mileage allowance and per diems also be calculated automatically?

YesPersonnel cloud takes over the automatically calculates of mileage allowances, per diems and lump sums based on the Austrian legislation and individual company guidelines.

Is travel expense reporting legally mandatory for Austrian companies?

Yes, Companies in Austria are obligated, Business travel expenses and related Expenses correctly, to be accounted for and stored. Digital solutions such as personnel clouds simplify this process considerably.

How does mobile travel expense recording via app work?

With the Personnel cloud app employees can use their Travel expenses, Expenses and Receipts directly on the move, upload and submit digitally. This saves time and ensures fast, correct billing.

Can travel policies and approval processes be integrated individually?

Yes, Personalwolke makes it possible, Individual travel guidelines and multistage Approval processes flexible integration. So all business trips and Settlements transparent, comprehensible and compliant.

How secure is my data with digital travel expense reports?

Personalwolke fulfills highest Data protection standards to GDPR. All data is encrypted transmission and safe in certified Data centers in Austria saved.

Is travel expense accounting suitable for small businesses and the self-employed?

Yeswhich travel and expense management system of Personalwolke is scalable and adapts to both small companies as well as large enterprises flexibly. Self-employed people and start-ups benefit in particular from the simple operation and time savings.

Can I test Personalwolke as a travel expense report free of charge?

YesYou can Personalwolke as Test digital travel expense report free of charge - for 30 days, without obligation and with all the functions for digital Expenses and travel expense accounting.